15+ Out Of This World Deferred Tax Calculation Example Excel Uk

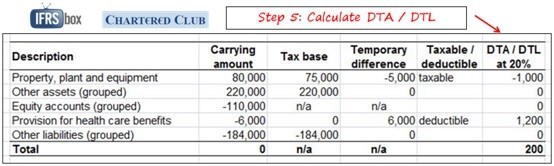

1 700 x 20 340 deferred tax liability.

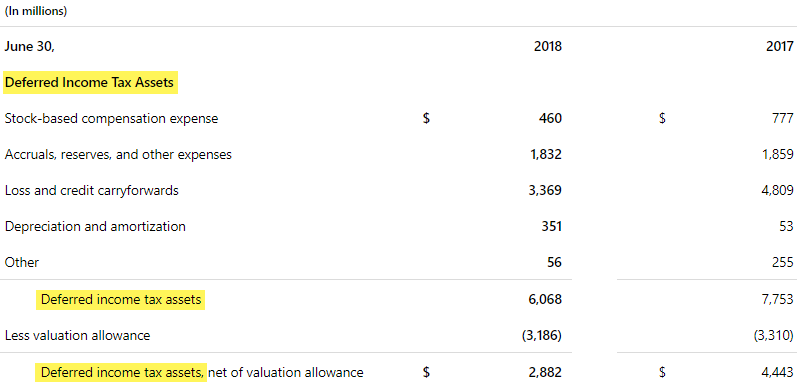

Deferred tax calculation example excel uk. Deferred Tax Calculator is an excel template to calculating the deffered tax of the accounting accounts whether it is assets or income account. Here an effort is made to comprise all tax computation viz Provision for Tax MAT Deferred Tax and allowance and disallowance of Depreciation under Companies Act and Income tax Act in one single excel. This ms excel templates can be opened using microsoft office Excel 2013 or newer and you can get it in Calculator excel category.

Scroll down and download Deferred Tax Calculation an easy way out in Excel format Manual calculation mode means that Excel will only recalculate all open workbooks when you request it by pressing F9 or Ctrl-Alt-F9 or when you Save a workbook. Would my deferred calculation be as follows. P buys debt instrument.

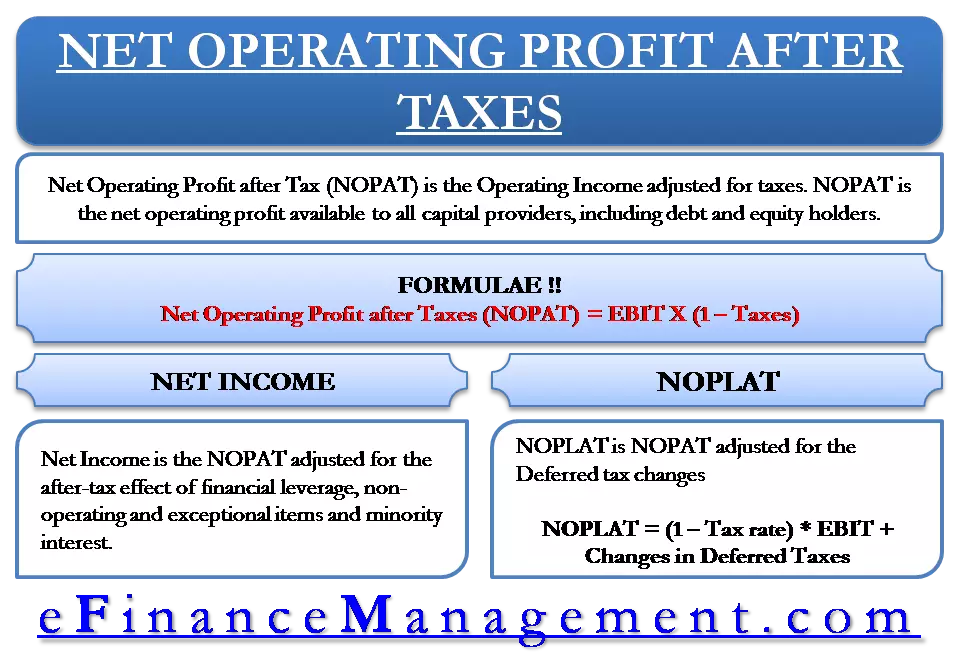

Dep as per Income Tax Act XX Difference in depreciation XX AddLess Other Timing Differences Total Timing Differences Tax benefit loss XX Tax Rate DTLDTA XX. Applying the IAS 12 amendments January 2016. I am preparing a first years set of accounts.

Diminishing balance depreciation without residual value. Simple calculation of defined benefit plan. P expects to collect full 1000 ie.

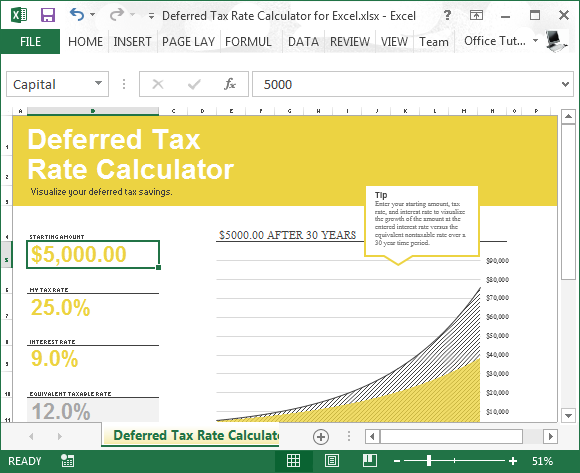

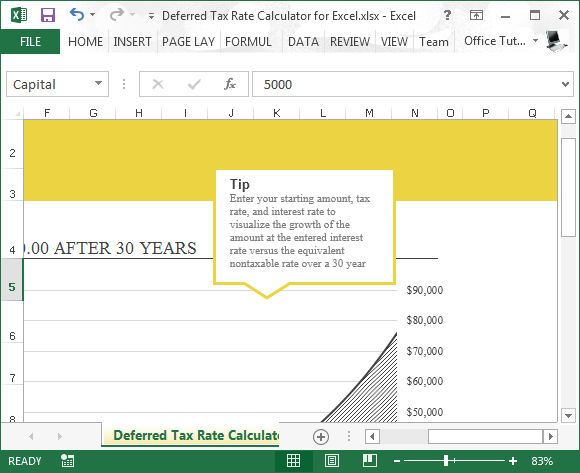

Download Excel Deferred Tax Rate Calculator Templates. An excel sheet to better understand the deferred tax calc. Excel Spreadsheet to calculate CT Frank Ahearn Wrote Following a large number of requests by email a copy of my spreedsheet has been sent to John Stokdyk of AccountingWEB.

Company A pays tax at 20. Sum of the digits depreciation. Diminishing balance depreciation with residual value.