8+ Breathtaking Deferred Tax Calculation Example Excel Uk

At 17 this gives rise to a deferred tax liability of 1 360 000.

Deferred tax calculation example excel uk. DTD expected to reverse. Exemption for initial recognition of leases under IFRS 16. Deferred Tax Calculation Example Uk.

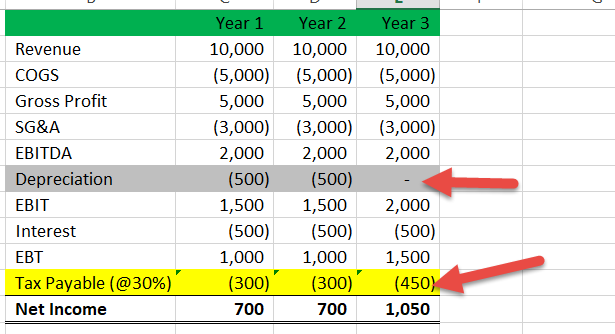

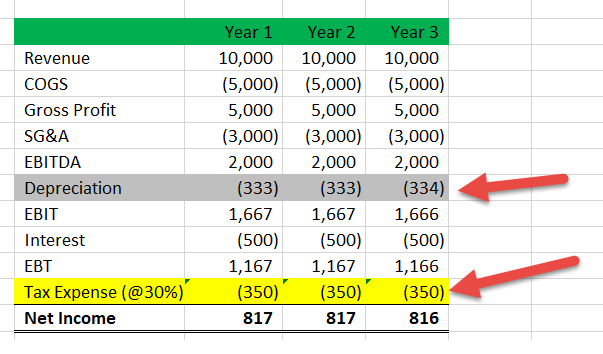

Deferred tax simple example. Dep as per Income Tax Act XX Difference in depreciation XX AddLess Other Timing Differences Total Timing Differences Tax benefit loss XX Tax Rate DTLDTA XX. Excel Spreadsheet to calculate CT Frank Ahearn Wrote Following a large number of requests by email a copy of my spreedsheet has been sent to John Stokdyk of AccountingWEB.

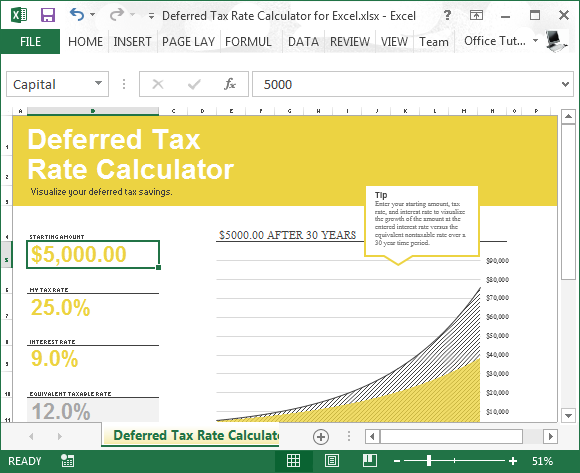

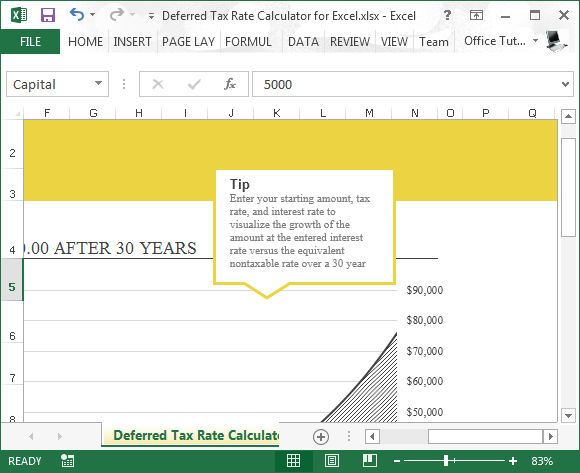

For those who have not emailed me directly I understand it will be available for download in the Excel. Download Excel Deferred Tax Rate Calculator Templates. IAS 12 excel examples.

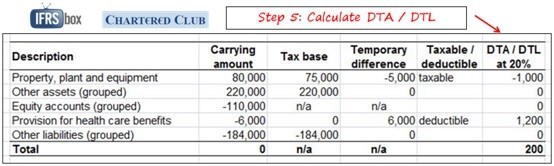

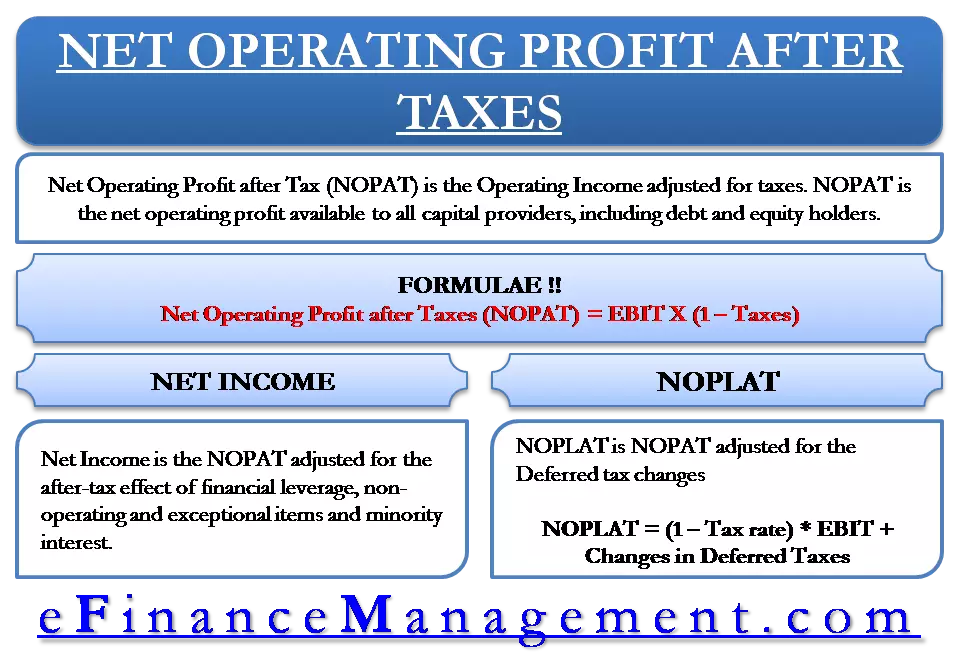

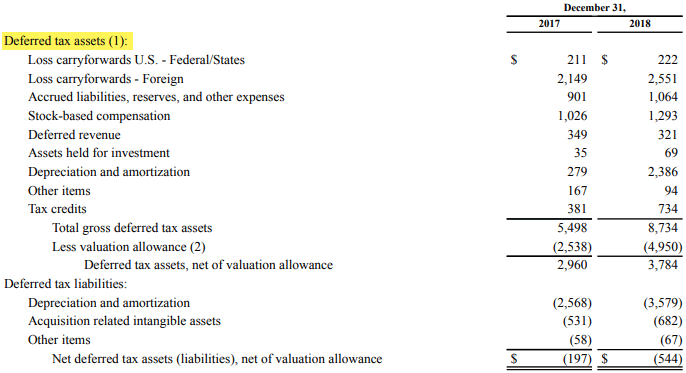

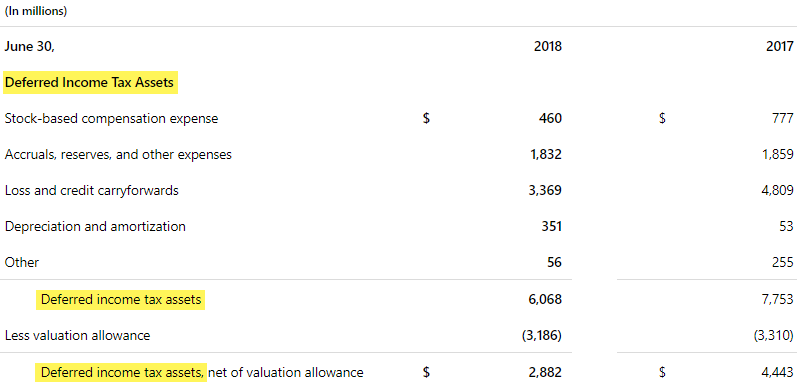

In accounting deferred tax meaning that a liability account on balance sheet that resulted because of the temporary differences between one of the account in accounting could be asset income or etc with the tax carrying the values. FRS12IAS12 requires several steps in determining deferred tax information first is the construction of a tax balance sheet that involved the determination of tax base for each asset and liability recognised in the accounting balance sheet in order. The difference between the tax base of the asset which is nil because tax relief has already been granted by HMRC in respect of the expenditure and the fair value of the intangible asset of 150000 gives rise to a deferred tax liability of 30000 150000 x 20.

Tax base 2000 less 2000 Nil. Unrelieved tax losses and deferred tax liabilities As at 31 December 20X7 Entity A has unrelieved corporation tax losses of 50000. 1 700 x 20 340 deferred tax liability.

This will be recorded by crediting increasing a deferred tax liability in the Statement of Financial Position and debiting increasing the tax expense in the Statement of Profit or Loss. Download Deferred Tax Calculation file in xls format- 13002 downloads. An excel sheet to better understand the deferred tax calc.