17+ Fantastic Deferred Tax Calculation Example Excel Uk

So at the year end the balance is 1700.

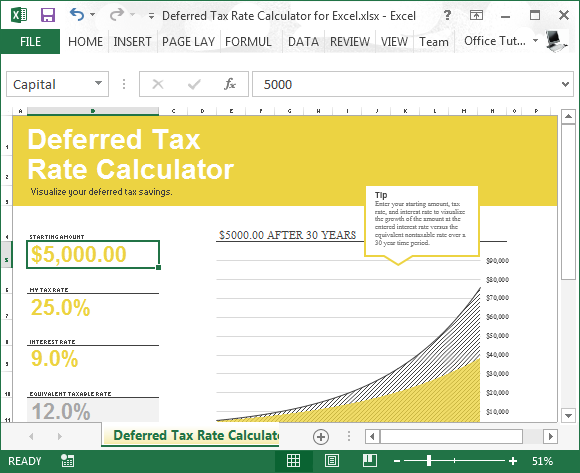

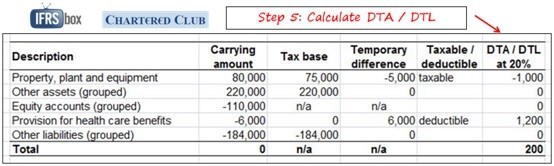

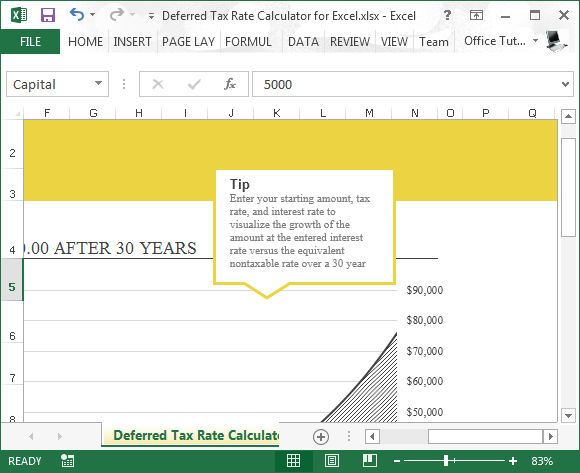

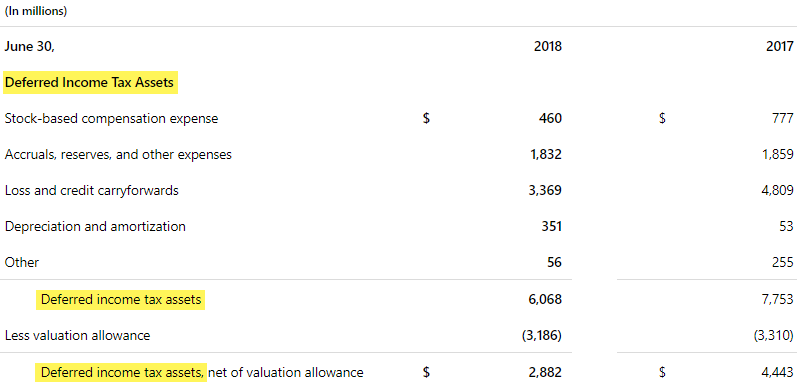

Deferred tax calculation example excel uk. Scroll down and download Deferred Tax Calculation an easy way out in Excel format Manual calculation mode means that Excel will only recalculate all open workbooks when you request it by pressing F9 or Ctrl-Alt-F9 or when you Save a workbook. Assuming that the tax rate applicable to the company is 25 the deferred tax liability that will be recognised at the end of year 1 is 25 x 300 75. Download Deferred Tax Calculation file in xls format- 13002 downloads.

IAS 12 excel examples. This ms excel templates can be opened using microsoft office Excel 2013 or newer and you can get it in Calculator excel category. Diminishing balance depreciation without residual value.

The difference between the tax base of the asset which is nil because tax relief has already been granted by HMRC in respect of the expenditure and the fair value of the intangible asset of 150000 gives rise to a deferred tax liability of 30000 150000 x 20. 1 700 x 20 340 deferred tax liability. Applying the IAS 12 amendments January 2016.

This will be recorded by crediting increasing a deferred tax liability in the Statement of Financial Position and debiting increasing the tax expense in the Statement of Profit or Loss. DTD expected to reverse. Since the Deferred Tax Rate template is in fact just a simple calculator all youll need to do is enter a few items to receive the information you need.

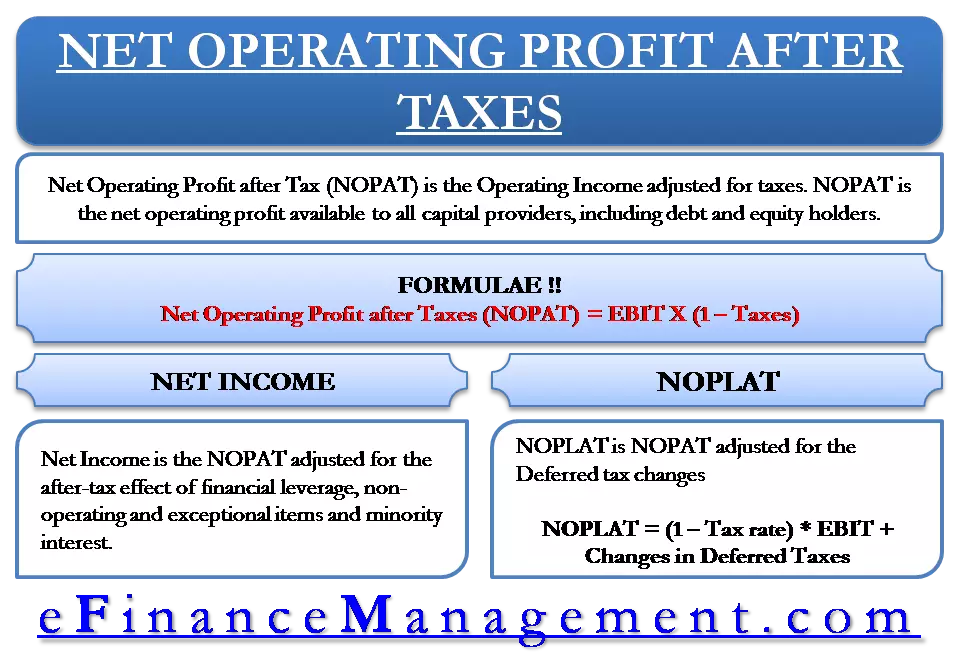

Purpose of deferred tax. Unrelieved tax losses and deferred tax liabilities As at 31 December 20X7 Entity A has unrelieved corporation tax losses of 50000. I want the formula to be able to calculate my approx earnings after deductions based on how many hours I work but it needs to also take into consideration extra earnings and higher tax as a result of working overtime.

For those who have not emailed me directly I understand it will be available for download in the Excel. Simply click inside the cell and enter the figure in dollars. I am preparing a first years set of accounts.